Hey guys, In this article, we look at Tata Power’s core business, its commitment to sustainable energy, and recent developments that highlight the company’s role as a revolutionary force in the industry.

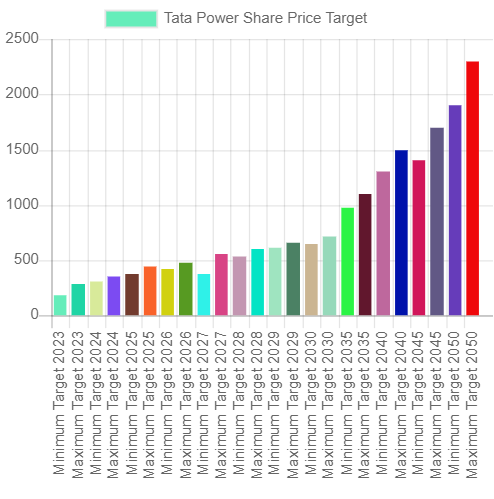

Overview of Tata Power Share Price Target

Here is a fast overview of the Tata Power share price target overview for those who don’t have time to read the entire article, but it is recommended that you read the entire article to fully comprehend the details of the Tata Power share price targets.

| Year | Minimum Target (Rs) | Maximum Target (Rs) |

|---|---|---|

| 2023 | ₹182 | ₹280 |

| 2024 | ₹310 | ₹350 |

| 2025 | ₹380 | ₹440 |

| 2026 | ₹420 | ₹480 |

| 2027 | ₹380 | ₹560 |

| 2028 | ₹530 | ₹600 |

| 2029 | ₹610 | ₹660 |

| 2030 | ₹650 | ₹720 |

| 2035 | ₹980 | ₹1100 |

| 2040 | ₹1300 | ₹1500 |

| 2045 | ₹1400 | ₹1700 |

| 2050 | ₹1900 | ₹2300 |

Read More: Suzlon Share Price Target

Tata Power Business Profile

Tata Power, which was founded with the goal of providing reliable electricity to the populace, has evolved into a diversified energy company with a heavy emphasis on renewable sources.

Adapting to evolving technology and market demands, the corporation has effectively navigated the complexity of electricity generation, transmission, and distribution over the years.

Tata Power has an astounding total capacity of roughly 13,985 megawatts (MW) as per the most recent statistics, obtained from a broad portfolio of thermal, hydro, solar, wind, and waste-heat recovery projects across India.

Notably, thermal capacity accounts for around 57% of the company’s total capacity, followed by solar (25%), wind (8%), hydro (7%), and waste-heat recovery (3%).

Read More: Anupam Rasayan Share Price Target

Tata Power Products/Services

Tata Power’s core business is energy generation, transmission, and distribution with a sustainable focus.

The company’s power-producing sources have been expanded to cover both conventional and renewable energy technology.

The Generation Segment, which accounts for 64% of Tata Power’s revenue, is responsible for powering the country through hydroelectric and thermal power plants.

The Renewables Segment is dedicated to harnessing clean energy, specifically wind and solar energy, in order to lower its carbon footprint and contribute to India’s renewable energy ambitions.

The Transmission & Distribution division generates 35% of Tata Power’s revenue and ensures that electricity is delivered to retail consumers on time.

The “Others” section accounts for 1% of sales and comprises forward-thinking efforts such as project management contracts, infrastructure management services, rooftop solar projects, EV charging stations, property development, and oil tank leasing.

Tata Power is dedicated to emphasizing renewables, transmission and distribution excellence, and customer-centric solutions in order to establish itself as an energy pioneer.

Read More: Jio Financial Services Share Price Target

Recent Happenings in Tata Power

Recent events are what move stocks up and down; these are the factors that investors need to consider before investing in any stock because they can affect future returns of their investment.

- Increasing Electric Vehicle Charging Infrastructure Tata Power’s foresight may be seen in its attempts to promote the electric vehicle (EV) revolution.

- The company’s initiative to install over 450 EV charging stations along 350 national routes demonstrates its commitment to promoting cleaner transportation options.

- Solar Rooftop Development and DiversificationTata Power’s order book for Solar Rooftop of 393 MW worth 1,434 crore as of September 2022 demonstrates the increased demand for renewable energy solutions.

- Ample Orders for Solar Utility Scale EPCTata Power cements its position as a leader in large-scale solar projects with an order book of 15,261 crore for Solar Utility Scale Engineering, Procurement, and Construction (EPC) projects as of September 2022.

Read More: Transgene Biotek Share Price Target

Fundamental Analysis: Tata Power

In this fundamental analysis, we will take a look at Tata Power’s financial metrics, how they are performing in the industry, and what the advantages and disadvantages of Tata Power are. This will tell us whether or not you should invest in it.

| Metric | Value |

|---|---|

| Market Cap | ₹ 80,043 Cr. |

| Current Price | ₹ 250 |

| High / Low | ₹ 253 / 182 |

| Stock P/E | 23.8 |

| Book Value | ₹ 90.1 |

| Dividend Yield | 0.81 % |

| ROCE | 12.4 % |

| ROE | 12.6 % |

| Face Value | ₹ 1.00 |

| Profit after tax | ₹ 3,360 Cr. |

| Profit growth | 27.8 % |

| Sales growth | 18.3 % |

| Industry PE | 32.8 |

| Pledged percentage | 1.40 % |

| Earnings yield | 8.50 % |

| Promoter holding | 46.9 % |

| Net worth | ₹ 28,787 Cr. |

| Debt | ₹ 52,923 Cr. |

| Qtr Sales Var | 4.95 % |

| Return over 1year | 3.33 % |

| Return over 3years | 60.3 % |

| Return over 5years | 26.2 % |

| Sales growth 3Years | 23.7 % |

| Sales growth 5Years | 15.5 % |

| Profit Var 3Yrs | 133 % |

| Reserves | ₹ 28,468 Cr. |

| Debt to equity | 1.84 |

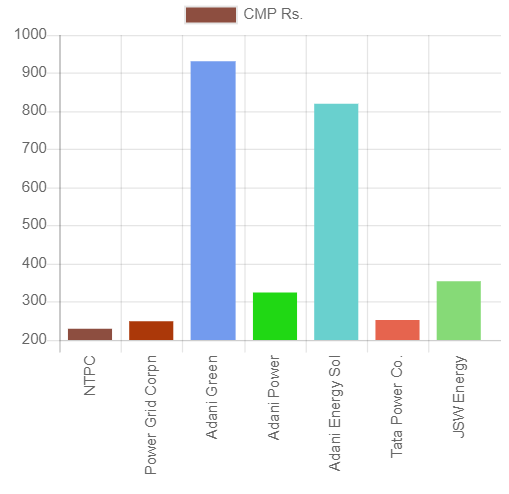

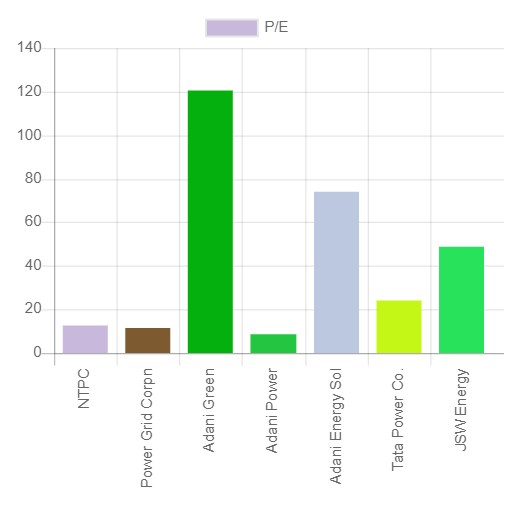

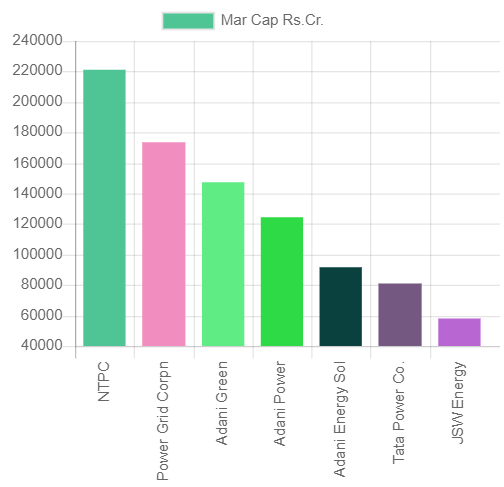

Comparison of Tata Power with its competitors

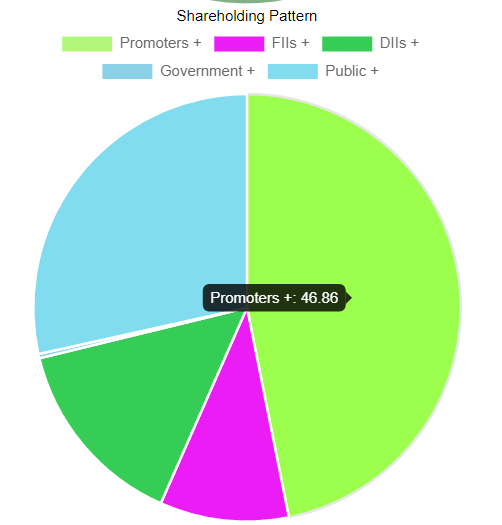

Shareholding Pattern

As you can see, most of the shareholders are promoters, which is a positive thing. 46 percent of the shares are held by promoters, with the rest of the shares divided between FIIS DIIS and the general public.

Read More: TATA STEEL SHARE PRICE TARGET 2023

Pros:

- Profit and Sales Growth: Tata Power has demonstrated strong profit growth at 27.8% and healthy sales growth at 18.3%. This indicates the company’s ability to effectively expand its revenue streams and increase profitability over time.

- Return on Equity (ROE) and Return on Capital Employed (ROCE): With ROE and ROCE figures of 12.6% and 12.4% respectively, Tata Power showcases its ability to efficiently utilize capital and generate returns for shareholders.

- Promoter Holding: The healthy promoter holding of 46.9% reflects strong confidence in the company’s prospects and aligns promoters’ interests with shareholders.

- Strong Reserves and Net Worth: Substantial reserves (₹ 28,468 Cr.) and net worth (₹ 28,787 Cr.) indicate a solid financial base and potential for strategic investments.

- Dividend Yield: A dividend yield of 0.81% provides an added incentive for investors seeking regular income from investments.

- Steady Performance: Tata Power’s consistent returns over the years, with a 3-year return of 60.3% and a 5-year return of 26.2%, demonstrate its ability to generate value for investors.

- Renewable Energy Focus: The company’s strategic focus on renewables aligns with global trends and positions Tata Power as a player in the transition to cleaner energy sources.

Cons:

- Debt Levels: Tata Power’s substantial debt of ₹ 52,923 Cr. could impact financial flexibility and interest obligations, potentially affecting profitability.

- Industry P/E Ratio: The company’s stock P/E ratio of 23.8 is below the industry average (32.8), suggesting the market may have slightly subdued growth expectations.

- Pledged Percentage: Although relatively low at 1.40%, any pledged shares could potentially impact stock stability.

- High Debt-to-Equity Ratio: A debt-to-equity ratio of 1.84 indicates a relatively high level of debt, which could increase financial risk.

Technical Analysis of Tata Power

Tata Power’s technicals are very solid. As you can see, the trendline I drew on the chart indicates that the stock will be on an upswing in the coming months, with huge profits possible within six or seven months.

As you can see, the moving average of 50 days is also displaying an uptrend, indicating that the uptrend will continue and the growth in Tata Power’s share price will continue.

The RSI (relative strength index) is also suggesting an uptrend, which is currently at 70 and will go beyond 70 in the near future, indicating that there will be an uptrend in the near future.

Based on these factors, we can conclude that Tata Power Stock will rise and meet all of the aims outlined in this article.

As of September 1, 2023, the Tata Power Share has returned 3% in the previous five days, 23% in the previous six months, and 235 in the previous five years. In the last five years, the stake has nearly doubled from 100 to 252 rupees.

As a result, this alone demonstrates that the company is good and will perform well in the future.

Tata Power Share Price Targets Overview

Understanding a company’s anticipated share price targets might provide significant information into its prospective growth trajectory as an investor.

Let’s take a look at Tata Power’s expected share price targets, including the estimated minimum and maximum values for each year:

Tata Power Share Price Target 2023

The year 2023 could witness the following dynamics that might influence Tata Power’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹182 |

| Maximum Target | ₹280 |

Minimum Target (₹182): With Tata Power’s diverse energy portfolio and focus on renewables, the company is poised to capitalize on the global shift towards sustainable energy sources. This, coupled with its steady sales growth of 18.3%, might contribute to achieving the minimum target share price.

Maximum Target (₹280): Tata Power’s strong profit growth at 27.8% showcases its ability to generate substantial earnings. Investors may view this as an indicator of the company’s growth potential, possibly driving the share price toward the maximum target.

Tata Power Share Price Target 2024

Looking forward to 2024, several elements could impact Tata Power’s share price movement:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹310 |

| Maximum Target | ₹350 |

Minimum Target (₹310): The company’s commitment to increasing its clean and green portfolio aligns with global sustainability trends, potentially supporting the share price toward the minimum target.

Maximum Target (₹350): As Tata Power continues to execute its strategic vision and enhance operational efficiencies, investors may see it as an attractive investment. This, along with the anticipated growth in the renewable energy market, could contribute to achieving the maximum target share price.

Tata Power Share Price Target 2025

The year 2025 holds potential for Tata Power’s share price trajectory, let’s talk about Tata Power’s share price in 2025

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹380 |

| Maximum Target | ₹440 |

Minimum Target (₹380): Tata Power’s strong presence across the energy value chain positions it to capture opportunities in various segments, including renewables, distribution, and services. This diversity might attract investors looking for stability and growth potential, potentially supporting the share price toward the minimum target.

Maximum Target (₹440): With Tata Power’s strategic focus on solar rooftops, EV charging, and innovative energy services, the company could gain traction in emerging markets. This could contribute to achieving the higher share price target, particularly if the company successfully leverages these growth avenues.

Tata Power Share Price Target 2026

In 2026, Tata Power’s share price journey could be influenced by:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹420 |

| Maximum Target | ₹480 |

Minimum Target (₹420): Tata Power’s commitment to achieving a clean and green portfolio aligns with global environmental goals.

Maximum Target (₹480): As Tata Power strengthens its position in the renewable energy sector, investors might view the company as a key player in the transition to clean energy sources.

Tata Power Share Price Target 2027

The year 2027 could witness the following dynamics that might influence Tata Power’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹380 |

| Maximum Target | ₹560 |

Minimum Target (₹380): Tata Power’s ongoing efforts to enhance energy services and expand its customer-centric offerings might attract investors seeking exposure to diversified revenue streams. This strategic approach could contribute to supporting the share price toward the minimum target.

Maximum Target (₹560): Tata Power’s strategic investments in renewables, transmission, and distribution could position it as a leading player in the energy sector.

Tata Power Share Price Target 2028

In 2028, Tata Power’s share price journey could be influenced by:

| Target | Tata Power Share Price (Rs) |

|---|---|

| Minimum Target | ₹530 |

| Maximum Target | ₹600 |

Minimum Target (₹530): Tata Power’s strategic presence across the energy value chain positions it to benefit from the growing demand for renewable energy solutions.

Maximum Target (₹600): As Tata Power executes its growth strategies and maintains its financial performance, investor confidence could rise.

Tata Power Share Price Target 2029

The year 2029 could witness the following dynamics that might influence Tata Power’s share price:

| Target | Tata Power Share Price (Rs) |

|---|---|

| Minimum Target | ₹610 |

| Maximum Target | ₹660 |

Minimum Target (₹610): Tata Power’s robust track record of revenue growth and strategic initiatives in renewables and energy services could appeal to long-term investors.

Maximum Target (₹660): As Tata Power solidifies its position as a leader in the energy sector, investors might consider the company as a key contributor to the transition to clean energy.

Tata Power Share Price Target 2030

The year 2030 holds potential for Tata Power’s share price trajectory:

| Target | Tata Power Share Price (Rs) |

|---|---|

| Minimum Target | ₹650 |

| Maximum Target | ₹720 |

Minimum Target (₹650): Tata Power’s dedication to achieving a clean energy portfolio could drive investor interest.

Maximum Target (₹720): As Tata Power continues to navigate the evolving energy landscape, its expertise in renewables and energy services could be instrumental. The company’s strategic growth initiatives, along with the anticipated growth in the renewable energy sector, might contribute to achieving the higher share price target.

Tata Power Share Price Target 2035

In 2035, Tata Power’s share price journey could be influenced by:

| Target | Tata Power Share Price (Rs) |

|---|---|

| Minimum Target | ₹980 |

| Maximum Target | ₹1100 |

Minimum Target (₹980): Tata Power’s commitment to harnessing the power of renewable sources aligns with global sustainability trends.

Maximum Target (₹1100): With its well-established position in the energy sector, Tata Power could benefit from the increasing demand for clean energy solutions. As governments and industries emphasize renewable energy adoption, the company’s diverse portfolio and strategic initiatives might contribute to achieving the higher share price target.

Tata Power Share Price Target 2040

Looking ahead to 2040, several elements could impact Tata Power’s share price movement:

| Target | Tata Power Share Price (Rs) |

|---|---|

| Minimum Target | ₹1300 |

| Maximum Target | ₹1500 |

Minimum Target (₹1300): The company’s ability to adapt to changing market dynamics and capitalize on growth opportunities might support the share price toward the minimum target.

Maximum Target (₹1500): The company’s strategic focus on expanding its renewable energy portfolio and leveraging technological advancements might contribute to achieving the higher share price target.

Tata Power Share Price Target 2045

In 2045, Tata Power’s share price journey could be influenced by:

| Target | Tata Power Share Price (Rs) |

|---|---|

| Minimum Target | ₹1400 |

| Maximum Target | ₹1700 |

Maximum Target (₹1700): With Tata Power’s continued expansion in the renewable energy sector, the company could capture opportunities arising from increased demand for clean energy solutions. Its strategic investments in solar, wind, and EV charging might contribute to achieving the higher share price target.

Tata Power Share Price Target 2050

Looking ahead to 2050, several elements could shape Tata Power’s share price movement:

| Target | Tata Power Share Price (Rs) |

|---|---|

| Minimum Target | ₹1900 |

| Maximum Target | ₹2300 |

Minimum Target (₹1900): Tata Power’s enduring legacy in the energy sector, coupled with its commitment to sustainability, could resonate with investors seeking long-term value.

Maximum Target (₹2300): With Tata Power’s strategic positioning in the renewable energy landscape, the company could capitalize on the growing demand for clean energy solutions.

Personal View on Tata Power Share Price

According to me, Tata Power is the best stock available right now to invest as it has been already given multi-bagger returns over a period of 5 years, so it’s most anticipated that the stock will do the same for the next five years. Also as we have seen the fundamentals and technicals of this stock are also solid. Therefore it’s a clear-cut indication that the stock will rise in the future and once again it will be a multi-bagger.

Frequently Asked Questions

What will be Tata Power’s share price till 2030?

Tata Power’s share price in 2030 will be around a minimum ₹650 and a maximum of up to ₹730.

What is the target of Tata Power in 2025?

Tata Power’s target share price in 2025 ranges from a minimum of ₹380 to a maximum of ₹440, read more in the article.

Can we invest in Tata Power for the long term?

Yes, Tata Power can be viewed as a long-term investment opportunity, particularly for individuals interested in green energy. The company’s dedication to clean energy and sustainability corresponds to long-term worldwide trends.

What will be Tata Power’s share price in 2024?

The share price prediction for Tata Power in 2024 varies between 310 and 350.

What will be Tata Power’s share price in 2050?

Tata Power’s share price target in 2050 ranges from a minimum of ₹1900 to a maximum of ₹2300

What is the price of Tata Power share in 2040?

Tata Power’s share price target in 2040 ranges from a minimum of ₹1300 to a maximum of ₹1500.

What is Tata Power’s future plan?

Tata Power’s future goals include an emphasis on renewable energy, transmission and distribution development, and a variety of customer-focused programs such as solar rooftops, electric vehicle charging, microgrids, and more. The company’s mission is to establish a clean and green energy portfolio that aligns with global sustainability objectives. It is advised that you read Tata Power’s official releases and publications for further information on the company’s future intentions.

Conclusion

Tata Power’s share price ambitions, which extend until 2050, show a path toward a more sustainable energy future. These targets, which range from 182 to 2300, indicate the company’s strategic focus on sustainable energy, innovation, and market flexibility.

Tata Power, as a long-term investment, offers potential growth opportunities, especially for those interested in renewable energy solutions. The company’s dedication to a clean and green energy portfolio corresponds with global sustainability trends, making it an appealing investment option.

However, it’s essential for investors to conduct thorough research, stay informed about market conditions, and consider their investment objectives.

1 thought on “TATA Power Share Price Target in 2023, 2024, 2025, 2026, 2027, 2030, 2040, 2050”