Hey there, Let’s discuss about something that’s been making headlines – Jio Financial Services Limited. You might remember them as Reliance Strategic Investments Limited. Well, they’ve got a shiny new name after parting ways with Reliance Industries in July 2023. Exciting news: you can start trading their shares from August 21, 2023. Curious to know more?

Company Profile and Numbers

Company Profile:

Jio Financial Services Limited, emerging as a notable player in the financial sector, stands out with its fresh approach to lending and financial solutions. Originally known as Reliance Strategic Investments Limited, the company embarked on a new journey with its rebranding after the demerger from Reliance Industries in July 2023. As of August 21, 2023, the company’s shares have become tradable, drawing the attention of investors and market observers alike. Under the leadership of Chairman KV Kamath, Jio Financial Services aims to redefine accessibility and inclusivity in the financial services landscape.

The company’s core operations encompass offering loans tailored to individuals and businesses, with loan amounts starting as modest as INR 5,000. However, Jio Financial Services doesn’t stop at lending; it has established strategic collaborations with various entities including Reliance Payment Solutions, Reliance Retail Finance, Jio Payments Bank, Jio Information Aggregator Services, and Reliance Retail Insurance Broking Ltd. This multifaceted approach positions Jio Financial Services as a comprehensive financial services provider, capable of addressing diverse financial needs.

Numbers:

According to an article by ICCIDIRECT on Jio Financial Ltd, an intriguing observation has taken the spotlight. The initial premium attached to the share prices of Jio Financial Services has drawn significant attention. Although industry experts had projected a value ranging from 160 to 190, the market surprised everyone by setting a price of Rs 261.85 per share on July 20th, signifying a considerable premium.

Regarding the company’s financial performance, Jio Financial Services reported a net profit after tax of Rs 145 crore for Q1FY23, with a revenue of Rs 215 crore. However, to truly gauge the company’s trajectory, a look at the previous annual numbers is essential. For FY21 and FY22, the company reported revenue figures of Rs 2.95 crore and Rs 1.84 crore respectively, accompanied by profits of Rs 1.23 crore and Rs 1.68 crore. While these figures signify significant growth, it’s important to note that they still appear small in comparison to industry peers. In fact, they currently lack the magnitude required for a meaningful comparison.

Intriguingly, Jio Financial Services’ potential focus on consumer durable lending, particularly among users seeking credit for electronic purchases at Reliance Retail stores, adds an interesting dimension to its future strategy.

As the company continues to evolve, these numbers and insights provide a glimpse into its trajectory within the financial services sector. Keep in mind, though, that the financial landscape is ever-evolving, and these figures might just be the beginning of an exciting journey for Jio Financial Services.

Fundamentals of Jio Financial Services

The following data is according to screener, as Jio financial services listed on 21 august 2023, currently we don’t have that much of data available to get full picture but as the stock will trade, we’ll get the analytics of it.

| Metric | Value |

|---|---|

| Current Price | ₹ 252 |

| ROCE | 8.25 % |

| ROE | 7.84 % |

| Face Value | ₹ 10.0 |

| Profit after tax | ₹ 168 Cr. |

| Profit growth | 36.6 % |

| Sales growth | -51.0 % |

| Industry PE | 22.6 |

| Net worth | ₹ 2,228 Cr. |

| Debt | ₹ 0.00 Cr. |

| Profit Var 3Yrs | 34.2 % |

| Reserves | ₹ 2,226 Cr. |

| Debt to equity | 0.00 |

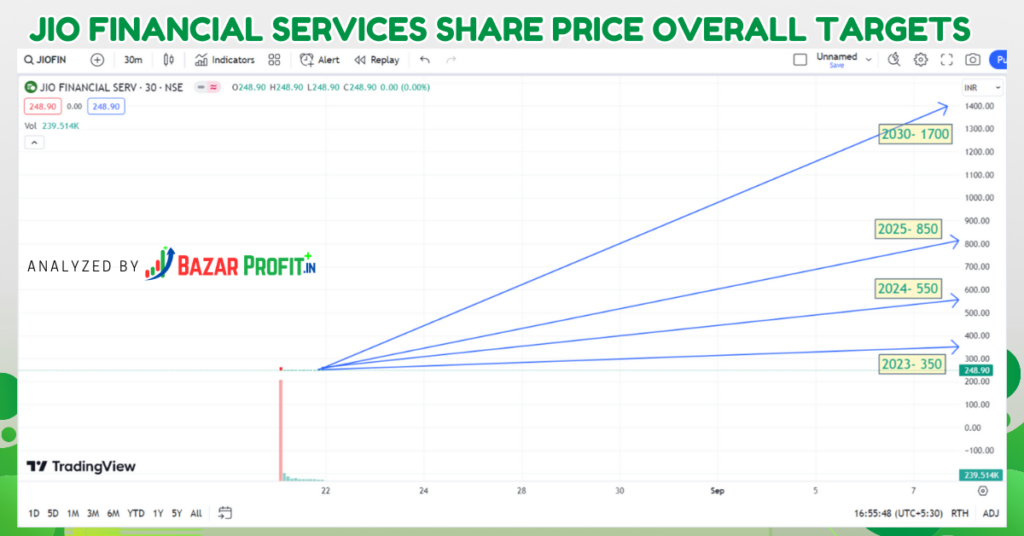

Jio Financial Services Share Price Target

Now lets take a look at the Jio Financial Share Price Target for 2023,2024,2025,2030 as this stock is listed at price of ₹261.85 on 21 august 2023 and after one trading session the stock price was at ₹251. So yes, there was a hype regarding the stock but we will see how it performs in future based on its fundamental analysis.

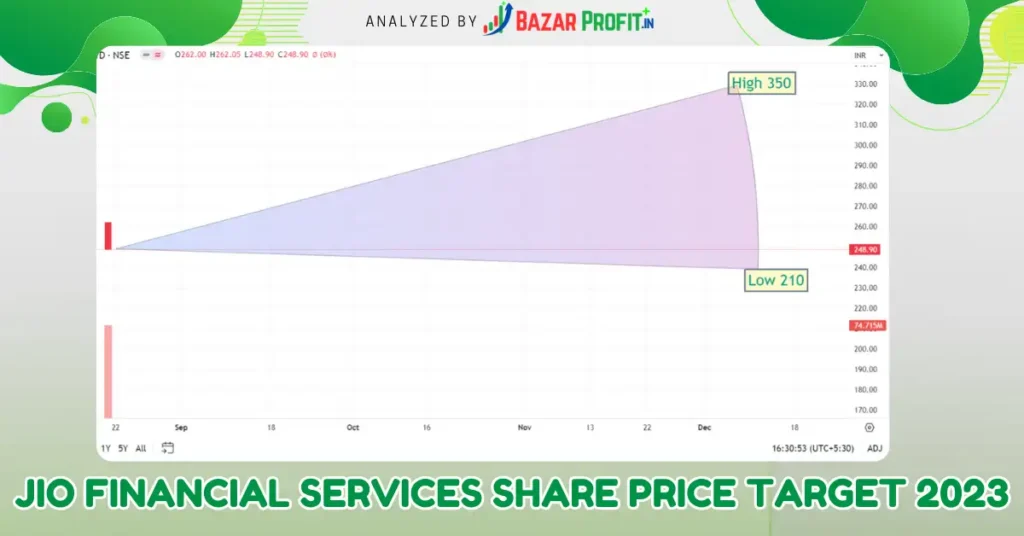

Jio Financial Services Share Price Target 2023

In the evolving landscape of financial preferences, the Indian populace’s inclination towards loans has shifted dramatically over the past few decades. This shift has led to Mukesh Ambani’s strategic decision to separate the business from Jio Financial.

| Year | Minimum Share Price Target | Maximum Share Price Target |

|---|---|---|

| 2023 | Rs. 230 | Rs. 350 |

Examining the company’s performance in 2022, Jio Financial extended loans totaling 9,149 crores, yielding a net profit of 1.68 crores. Comparing with previous years, the company reported a net profit of 1.23 crores in 2021 and a notable 2.30 crores in 2020.

Jio Financial Services Share Price Target 2024

| Year | Minimum Share Price Target | Maximum Share Price Target |

|---|---|---|

| 2024 | Rs. 400 | Rs. 550 |

Bajaj Finance holds a significant position in the Indian stock market’s financial sector, boasting profit growth ranging from 26% to 36%. The potential to achieve double-digit growth within this sector is evident, prompting Reliance Industries to expand its presence. Jio Financial Services’ capacity to challenge Bajaj Finance positions it for an ambitious target in 2024. With the MAXIMUM set at Rs. 550 and MINIMUM at Rs. 400, a competitive push in the finance sector could yield substantial results.

Jio Financial Services Share Price Target 2025

| Year | Minimum Share Price Target | Maximum Share Price Target |

|---|---|---|

| 2025 | Rs. 500 | Rs. 800 |

In a digital age dominated by mobile transactions, lending via mobile applications gained popularity until certain loan apps were banned by the Indian government. This ban has inadvertently benefited Indian loan providers like Jio Financial Services. The company’s strategic joint venture with BlackRock, a global asset management leader, adds a new dimension. Managing a staggering $8.5 trillion in assets, BlackRock’s expertise promises to bolster Jio Financial’s offerings. This partnership propels Jio Financial Services’ targets for 2025 to Rs. 500 (minimum) and Rs. 800 (maximum).

Jio Financial Services Share Price Target 2030

| Year | Minimum Share Price Target | Maximum Share Price Target |

|---|---|---|

| 2030 | Rs. 1700 | Rs. 1900 |

Reflecting on Reliance Industries’ success in the telecommunications sector with Jio’s entry, it’s clear that effective management is crucial for market sustainability. A parallel can be drawn in the finance services sector, wherein Jio Financial’s entrance is poised to reshape the landscape. The anticipated impact on competitors foretells substantial growth for Jio Financial Services. With a projected target range of Rs. 1700 (minimum) to Rs. 1900 (maximum) by 2030, the company’s journey could prove transformative.

Conclusion

While the company’s financial performance is notable, with a reported net profit of Rs 145 crore for Q1FY23 and promising growth compared to previous years, it’s evident that the numbers are just the beginning of a larger narrative. With projected targets for 2023, 2024, 2025, and even 2030, Jio Financial Services is poised for transformative growth.

As we gaze into the future, the projected share price targets illustrate an ambitious trajectory. With potential targets ranging from Rs. 261 to Rs. 350 for 2023, from Rs. 400 to Rs. 550 for 2024, from Rs. 500 to Rs. 800 for 2025, and from Rs. 1700 to Rs. 1900 for 2030, the company’s journey seems to be a promising one, set to challenge and reshape the landscape of the financial sector.

FAQ

-

What will be the price of Jio Finance share?

The Jio Financial Services share price was opened with ₹261.85 but in the first trading session its currently trading at ₹251.

-

Is Jio Financial a Good Buy?

Jio Financial Services holds potential as an investment due to its fresh approach in the financial sector. The initial premium on its share prices indicates market optimism. Yet, thorough research is vital before investing, considering its history, competition, and market trends.

-

Is It Good to Invest in Jio Financial Services?

Investing in Jio Financial Services offers opportunities and risks. Its diverse financial services approach and projected share price targets reflect promise. Personal financial goals, risk tolerance, and in-depth analysis of its performance and market position should guide investment decisions.

-

What Is the Valuation of Jio Financial Services?

As of August 21, 2023, Jio Financial Services’ share price is Rs 251, exceeding expert estimates. This valuation is influenced by market dynamics, sentiment, and performance. Monitoring market trends and news helps understand its valuation.

-

What Does Jio Financial Services Do?

Jio Financial Services offers tailored lending and financial solutions. After rebranding from Reliance Strategic Investments Limited, it provides loans from INR 5,000 to individuals and businesses. Collaborations with entities like Reliance Payment Solutions make it a comprehensive financial services provider.

-

Who Is the CEO of Jio Financial Services?

Chairman KV Kamath leads Jio Financial Services. His expertise shapes the company’s growth post its separation from Reliance Industries. Kamath’s vision guides its pursuit of innovative financial solutions in the evolving market landscape.

8 thoughts on “Jio Financial Services Share Price Target 2023,2024,2025,2030”