Today, we’ll look at the Anupam Rasayan Share Price Targets and how the company will likely perform. Is it risky to invest in this company? Anupam Rasayan India Ltd. is a well-known name in the stock market, drawing both experienced and novice investors. This forward-thinking company specializes in the production of one-of-a-kind chemicals, having a significant presence in both local and global markets. In this post, we will look at Anupam Rasayan’s remarkable narrative, including its business strategy, product line, customer partnerships, and recent accomplishments.

Company Profile

Anupam Rasayan India Ltd., which was founded with the goal of revolutionizing the chemical business, has drawn recognition for its outstanding production of specialized chemicals. The company’s origins may be located, and it has experienced growth and innovation on an upward track ever since. Because of its dedication to quality and innovation, Anupam Rasayan has continuously attracted the attention of investors and business leaders.

Company Business and Products/Services

Anupam Rasayan’s distinctive business strategy and wide range of goods and services are the keys to its success. The company generates over 92% of its total revenues from the industry of Life Science Specialty Chemicals. Anupam Rasayan provides a wide range of specialty chemicals within this sector, spanning numerous categories and serving a variety of industries.

- Agrochemicals: The company’s portfolio includes insecticides, fungicides, herbicides, and plant growth regulators, contributing significantly to agricultural productivity and sustainability.

- Personal Care: Anupam Rasayan plays a vital role in the personal care industry by providing antibacterial and ultraviolet protection intermediates and ingredients, enhancing the quality and safety of personal care products.

- Pharmaceuticals: The company’s involvement in the pharmaceutical sector is evident through its development of intermediates and key starting materials for Active Pharmaceutical Ingredients (APIs), contributing to advancements in healthcare and medicine.

Anupam Rasayan produces and sells Other Specialty Chemicals in addition to Life Science Specialty Chemicals, which account for about 8% of its sales. Specialty pigments, dyes, and polymer additives are some of them, which further broaden the company’s market penetration.

Fundamental Analysis: Anupam Rasayan’s Financial Performance

Understanding a company’s core financial parameters as an investor is essential for making wise choices. Let’s examine the information in detail and examine the financial performance of Anupam Rasayan India Ltd. We can identify the company’s strengths and areas that require attention by looking at important indicators and trends.

Financial Figures

Here’s a table of Anupam Rasayan’s essential financial metrics:

| Metric | Value |

|---|---|

| Market Cap | ₹ 10,810 Cr. |

| Current Price | ₹ 1,006 |

| High / Low | ₹ 1,250 / 570 |

| Stock P/E | 60.1 |

| Book Value | ₹ 221 |

| Dividend Yield | 0.25 % |

| ROCE | 12.9 % |

| ROE | 8.82 % |

| Face Value | ₹ 10.0 |

| Profit after tax | ₹ 180 Cr. |

| Profit growth | 12.5 % |

| Sales growth | 39.0 % |

| Industry PE | 30.4 |

| Pledged percentage | 0.00 % |

| Earnings yield | 3.54 % |

| Promoter holding | 60.8 % |

| Net worth | ₹ 2,373 Cr. |

| Debt | ₹ 822 Cr. |

| Qtr Sales Var | 12.4 % |

| Return over 1 year | 31.5 % |

| Return over 3 years | % |

| Return over 5 years | % |

| Sales growth 3 Years | 44.7 % |

| Sales growth 5 Years | % |

| Profit Var 3 Yrs | 50.6 % |

| Reserves | ₹ 2,265 Cr. |

| Debt to equity | 0.35 |

Pros:

- Robust Profit and Sales Growth: Anupam Rasayan has exhibited impressive profit growth of 12.5% and an outstanding sales growth of 39.0%. These figures highlight the company’s ability to generate healthy returns on its operations and capture an expanding market share.

- Strong Return on Capital Employed (ROCE): The ROCE stands at 12.9%, indicating that the company efficiently utilizes its capital to generate profits. This signifies effective management of resources and a sustainable business model.

- Diversified Product Portfolio: The company’s broad range of specialty chemicals across different sectors, including agrochemicals, personal care, and pharmaceuticals, positions it well to tap into various markets and reduce risk associated with dependence on a single sector.

- Healthy Promoter Holding: With a promoter holding of 60.8%, Anupam Rasayan benefits from significant promoter involvement and confidence in the company’s operations.

Cons:

- High Price-to-Earnings Ratio (P/E): The stock’s P/E ratio of 60.1 suggests that it might be relatively expensive compared to its earnings. Investors should carefully assess whether the stock’s valuation aligns with their investment strategy.

- Moderate Return on Equity (ROE): The ROE of 8.82% indicates that the company’s profitability in relation to shareholders’ equity is moderate. Improving this metric could enhance shareholder value.

- Debt Level: The company carries a debt of ₹822 Cr., which could impact its financial flexibility and increase interest costs. Monitoring the debt management strategy will be crucial.

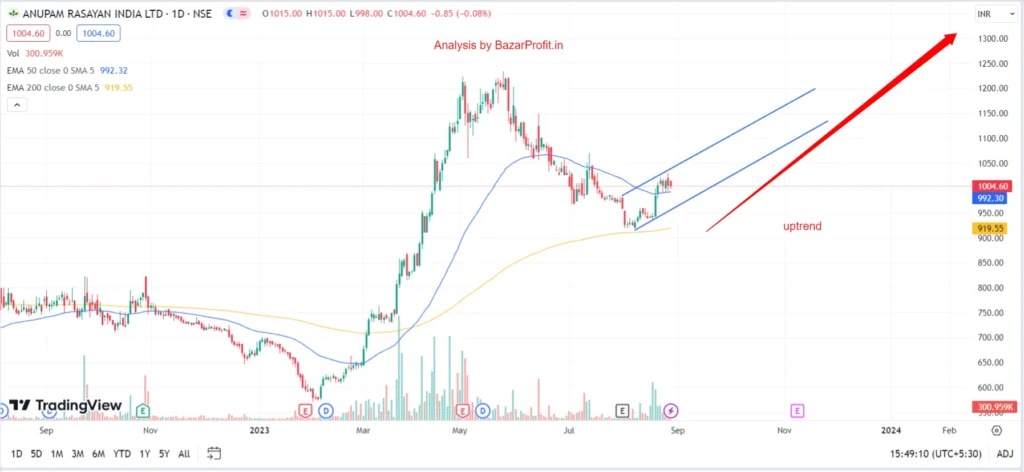

Technical Analysis of Anupam Rasayan India

The chart shows that the upcoming move will be good, since the chart is drawn on August 29, 2023. With this in mind, we can predict that this stock will continue to increase positively. This stock has generated 103% returns over the last five years and is anticipated to do so again in the next five years.

ANURAS Share Price Targets Overview

Having a clear idea of future price targets can have a big impact on your investment decisions in the complex world of stock trading. This section gives a thorough overview of Anupam Rasayan India Ltd’s anticipated share price projections for the following years for shareholders and potential investors. You may learn more about the company’s growth trajectory and assess whether it would be a good addition to your investment portfolio by digging deeper into these estimates.

Here’s an overview of Anupam Rasayan’s projected share price targets for the next few years:

| Year | Minimum Target (Rs) | Maximum Target (Rs) |

|---|---|---|

| 2023 | 875 | 1100 |

| 2024 | 1300 | 1500 |

| 2025 | 1400 | 1700 |

| 2026 | 1550 | 1900 |

| 2030 | 2260 | 2500 |

Anupam Rasayan Share Price Target 2023

In 2023, the company has charted an optimistic path with the following share price targets:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | 875 |

| Maximum Target | 1100 |

- Minimum Target (Rs 875): Anupam Rasayan’s strong sales growth of 39.0% shows the company’s ability to secure a sizable market share, which may strengthen investor confidence and support a potential increase in its share price.

- Maximum Target (Rs 1100): The company is well-positioned to take advantage of several revenue streams thanks to its wide product range, which includes agrochemicals, personal care products, and pharmaceuticals. This might push the share price closer to the higher objective.

Anupam Rasayan Share Price Target 2024

Looking ahead to 2024, the company aims for continued growth as reflected in its share price targets:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | 1300 |

| Maximum Target | 1500 |

- Minimum Target (Rs 1300): The company’s growing client base of 65 clients worldwide, including 18 Multinational Corporations, proves its capacity to gain and retain customers, enhancing revenue prospects and potentially elevating the share price.

- Maximum Target (Rs 1500): With a 31.5% return in the previous year, investors may perceive Anupam Rasayan’s track record as an indication of stability and growth potential, supporting the higher share price objective.

Anupam Rasayan Share Price Target 2025

The year 2025 paints an ambitious picture for Anupam Rasayan’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | 1400 |

| Maximum Target | 1700 |

- Minimum Target (Rs 1400): Anupam Rasayan’s 12.5% profit rise demonstrates its strong operations management and cost-efficiency, which may attract investors looking for a financially healthy company and potentially boost its share price.

- Maximum Target (Rs 1700): The company’s geographical revenue breakdown, with 28% coming from Europe and 15% coming from Japan, demonstrates its diverse market presence, thereby decreasing risks and increasing investor confidence in its growth potential.

Anupam Rasayan Share Price Target 2026

In 2026, the company envisions a trajectory of growth, as indicated by its share price targets:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | 1550 |

| Maximum Target | 1900 |

- Minimum Target (Rs 1550): The company’s commitment to R&D, as seen by its in-house R&D facilities, could result in the development of novel goods, strengthening its competitive edge and perhaps driving the share price higher.

- Maximum Target (Rs 1900):Anupam Rasayan’s increasing manufacturing capacity, which has more than doubled in the last three years, demonstrates the company’s commitment to expanding its production capabilities, which investors may view as promising for future revenue growth and share price appreciation.

Anupam Rasayan Share Price Target 2030

Peering into the future, Anupam Rasayan maintains its forward momentum with ambitious share price targets:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | 2260 |

| Maximum Target | 2500 |

The company’s strategic expansion plans and steady growth in profits and sales may draw in investors looking for long-term investments, which could eventually lead to an increase in share price.

It’s important to note that while these projections offer insight into Anupam Rasayan’s growth aspirations, they are subject to a range of market influences and internal developments. Investors are advised to conduct thorough research, seek advice from financial professionals, and consider their investment goals before making decisions.

FAQ

What is the long term target of Anupam Rasayan?

Anupam Rasayan’s long-term targets are expected to reach Rs. 2500 by 2030.

Is Anupam Rasayan a good company?

Anupam Rasayan has proven to be strong in terms of its wide range of product offerings, client interactions, sales growth, and manufacturing capabilities. However, a number of factors, such as personal financial objectives, risk tolerance, market trends, and the investor’s evaluation of the company’s fundamentals and growth potential, determine whether a company is considered “good” for investment.

Is Anupam Rasayan a small cap company?

Anupam Rasayan has a market capitalization of $10,810 Cr. as of the information currently available, classifying it as a mid-cap company. A company may be classified as small-cap, mid-cap, or large-cap depending on the state of the market and changes in market capitalization.

What is Anupam Rasayan’s order from Japan?

The information that is currently available does not provide specific information about particular orders. According to its geographical revenue breakdown, Anupam Rasayan’s revenue is derived from a diverse client base across numerous regions, including Japan.

What is the product of Anupam Rasayan?

Manufacturing a variety of specialty chemicals is Anupam Rasayan’s area of expertise. Agrochemicals (insecticides, fungicides, herbicides, plant growth regulators), ingredients for personal care products (antibacterial, ultraviolet protection intermediates), pharmaceutical intermediates, specialty pigments, specialty dyes, and polymer additives are all included in its product line.

Who are the competitors of Anupam Rasayan India Ltd.?

Anupam Rasayan competes with a number of other market players in the specialty chemicals sector. Some of its rivals are businesses that manufacture comparable specialty chemicals and goods, including agrochemicals, ingredients for personal care products, and pharmaceutical intermediates.

Who are the customers of Anupam Rasayan?

Anupam Rasayan serves about 65 clients worldwide and caters to a diverse clientele. This consists of a mixture of domestic and foreign clients. Notably, the clientele of the business is highly concentrated, with its top 10 customers accounting for a sizeable portion of its earnings.

Who is the owner of Anupam Rasayan?

The ownership of Anupam Rasayan India Ltd. is split among a number of shareholders and it is publicly traded on the stock market. It is significant to note that both institutional and private investors own shares of the company in its ownership structure.

Conclusion

With its diversified product portfolio and solid client relationships, Anupam Rasayan India Ltd has had a considerable effect on the specialty chemicals market. The company’s commitment to R&D, process innovation, and product enhancement has resulted in a strong return on capital invested and return on equity. Anupam Rasayan’s forecasted share price targets hint at possible growth, but investors must approach investing selections with caution, taking into account market dynamics, economic movements, and industry trends.

7 thoughts on “Anupam Rasayan Share Price Target 2023, 2024, 2025, 2026, 2030”