Update: We are pleased to announce that our predicted Suzlon share price target has successfully reached its target of ₹34 in 2023 and currently trading at a price of ₹37.60. So rest assured, all our share price targets are well-researched and provided by the experienced BazarProfit team.

Hello everyone, In this blog post, we will look at the Suzlon Share Price Target for 2023 and the years ahead up to 2080.

To forecast the share price targets for upcoming years, we must first understand the company’s fundamentals and technicals, thus we will go into great detail in this article to learn about Suzlon Energy’s targets for the future.

For those who don’t have time to read the whole thing and are only interested in the targets, here is a table of Suzlon Share Price targets projected by Bazarprofit.in,

Overview of Suzlon Share Price Targets

Suzlon Energy is a leader in the rapidly changing field of renewable energy, harnessing the force of the wind to create a more sustainable future.

| Year | Suzlon Minimum Target (Rs) | Suzlon Maximum Target (Rs) |

|---|---|---|

| 2023 | ₹18 | ₹34(Reached) |

| 2024 | ₹32 | ₹67(Estimated) |

| 2025 | ₹50 | ₹80(Estimated) |

| 2026 | ₹72 | ₹110(Estimated) |

| 2027 | ₹102 | ₹147(Estimated) |

| 2030 | ₹178(Estimated) | ₹209(Estimated) |

| 2035 | ₹300(Approx) | ₹450(Approx) |

| 2040 | ₹350(Approx) | ₹500(Approx) |

| 2050 | ₹600(Approx) | ₹800(Approx) |

| 2060 | ₹700(Approx) | ₹875(Approx) |

| 2070 | ₹850(Approx) | ₹1050(Approx) |

| 2080 | ₹900(Approx) | ₹1200(Approx) |

The creative entrepreneur Tulsi Tanti founded this Indian company in 1995, and since then it has been on an amazing journey that combines creativity, difficulties, and victories.

Suzlon Energy’s evolution is a testament to the possibilities of clean and sustainable power, from its humble beginnings as a textile firm struggling with energy expenses to becoming a global player in wind energy solutions.

Read More: भारत में सबसे ज्यादा डिविडेंड देने वाली कंपनी लिस्ट 2023

Company Profile

The growing cost of electricity for Tulsi Tanti’s textile business catalyzed his transition from textiles to wind energy. Suzlon Energy was founded in 1995 as a result of this conundrum.

Tanti saw a future in which renewable energy would not only run his textile company but also completely alter the country’s energy system.

The business adopted a revolutionary strategy, delivering wind energy solutions with a distinctive financing model—clients provided 25% of the capital, and Suzlon provided the remaining funds through loans.

Although first dismissed, this concept finally gained acceptance, and by 2008, Indian banks were funding wind power projects.

Read more: जीजी इंजीनियरिंग शेयर प्राइस टारगेट 2025,2030,2035

Suzlon Energy’s expansion was built on a foundation of wind energy. The business has developed a specialized market for itself as a producer of wind turbine generators and related parts throughout the years.

Suzlon Energy has installed more than 20 GW of wind energy across 17 countries thanks to its unwavering pursuit of excellence.

More than 111 wind farms make up the company’s portfolio, adding an astounding 13,880 MW to the world’s renewable energy grid.

Notably, Suzlon Energy provides services to a wide range of clients, including electric utilities, businesses, and government agencies.

Read More: गोधा कैबकाॅन शेयर प्राइस टारगेट 2023,2024,2025,2030,2050

Suzlon Energy’s Business

Suzlon Energy’s success is built on its innovative products and complete services that span the full value chain of wind energy. The company’s product portfolio demonstrates its dedication to pushing the boundaries of wind turbine technology:

- S144 Wind Turbine Generator: This groundbreaking creation, built on the 3.x MW platform, is a testament to Suzlon’s ambition to conquer even the lowest wind regimes in India.

- S133 Wind Turbine Generator: Suzlon’s prowess shines in this 2.6 to 3.0 MW platform, designed to unlock the potential of challenging sites and optimize energy yield across diverse wind regimes.

- S120 Wind Turbine Generator: Built on the 2.1 MW platform, this versatile turbine comes in three variants and is tailor-made for low wind sites, adhering to IEC Class S standards.

- Classic Fleet: While Suzlon Energy phased out the manufacturing of older WTG models like S111, S97, S88, S82, S66, and S52, the company remains committed to the operation and maintenance of these turbines.

Suzlon Energy goes beyond turbines, providing a wide range of services and solutions. The company offers Operations and Maintenance Services for commissioned wind energy projects, including multi-brand wind turbine generators.

Suzlon’s entire strategy covers wind project development, execution, and technical evaluation, ensuring a smooth transition to sustainable wind power.

Here are the recent happenings in the Suzlon company shared by them on the X platform showcasing their Q2 FY24 Results of revenue and profit on 2nd November 2023,

Suzlon announces Q2FY24 results with healthier fundamentals and robust performance indicators, along with a net debt-free balance sheet post-successful completion of QIP.

— Suzlon Group (@Suzlon) November 2, 2023

To know more: https://t.co/p6L9bRG6PU #Suzlon #20GW #WindEnergy #RenewableEnergy #SustainableFuture pic.twitter.com/XfW3vymzSS

Fundamental Analysis: Suzlon Energy

The basic study of a company’s financial performance is a vital factor that requires insightful attention in the field of investments.

Delving into the data supplied can provide significant insights into Suzlon Energy’s current situation and its potential as a stock worthy of attention as prospective investors attempt to make informed selections.

Let’s break down the key financial metrics and explore both the strengths and challenges that Suzlon Energy faces:

| Metric | Value |

|---|---|

| Market Cap | ₹ 33,061 Cr. |

| Current Price | ₹ 24.6 [Updated on 9/11/23: ₹ 37.60] |

| High / Low | ₹ 38.0 / 6.60 |

| Stock P/E | 114 |

| Book Value | ₹ 0.88 |

| Dividend Yield | 0.00 % |

| ROCE | 20.6 % |

| Website url | Suzlon |

| Face Value | ₹ 2.00 |

| Profit after tax | ₹ 290 Cr. |

| Profit growth | 270 % |

| Sales growth | -12.9 % |

| Industry PE | 41.2 |

| Pledged percentage | 80.8 % |

| Earnings yield | 1.70 % |

| Promoter holding | 13.3 % |

| Net worth | ₹ 1,133 Cr. |

| Debt | ₹ 1,938 Cr. |

| Qtr Sales Var | -2.15 % |

| Return over 1 year | 226 % |

| Return over 3 years | 92.5 % |

| Return over 5 years | 30.2 % |

| Sales growth 3 Years | 26.2 % |

| Sales growth 5 Years | -5.96 % |

| Profit Var 3 Yrs | 27.4 % |

| Reserves | ₹ -1,355 Cr. |

| Debt to equity | 1.76 |

Pros:

As investors sift through the financial metrics, several positive points emerge:

- Profit Growth: Suzlon Energy has witnessed an impressive profit growth of 270%, signaling the company’s ability to enhance its earnings significantly.

- Return on Capital Employed (ROCE): A robust ROCE of 20.6% demonstrates the efficiency with which the company employs its capital to generate profits.

- Strong 1-Year Return: A remarkable return of 226% over the past year positions Suzlon Energy as a potential growth stock, enticing investors with the prospect of handsome returns.

- Recovery Over 3 and 5 Years: The company’s recovery over the past 3 and 5 years, with returns of 92.5% and 30.2% respectively, showcases a positive trend in performance and investor confidence.

Cons:

However, alongside these strengths, certain challenges warrant attention:

- Sales Growth: Suzlon Energy has faced a decline in sales growth, with a negative growth rate of -12.9%. This could indicate potential difficulties in expanding its market reach.

- High Pledged Percentage: The notable pledged percentage of 80.8% raises concerns about the company’s financial health and the level of risk associated with its operations.

- Reserves and Debt: The negative value of ₹ -1,355 Cr. in reserves and a substantial debt of ₹ 1,938 Cr. suggest a need for careful financial management and debt reduction strategies.

- Sales Growth Over 5 Years: The negative sales growth of -5.96% over the past 5 years highlights potential challenges in maintaining consistent growth and market expansion.

Suzlon Energy has strengths such as remarkable profit growth, healthy return metrics, and a high ROCE, but it also has issues such as diminishing sales growth and a high pledged proportion. Before investing in Suzlon Energy stock, investors must thoroughly analyze the advantages and cons, considering their risk tolerance and long-term investment goals.

Read More: Transgene Biotek Share Price Target

Comparison of Suzlon with its competitors

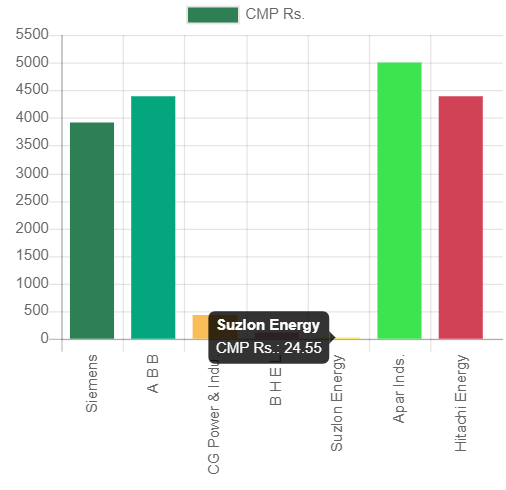

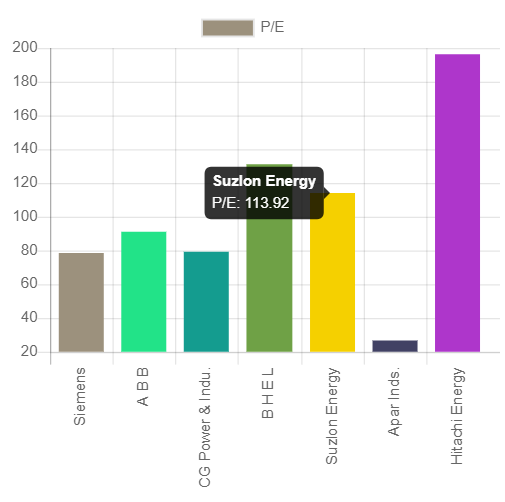

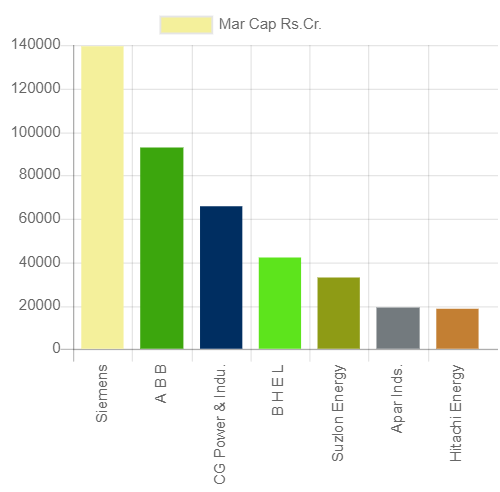

From the CMP (current market price), it is clear that Suzlon’s current market price is nothing in comparison to its competitors. As a result, it is a strong indication that the Suzlon share market price has a long way to go.

Suzlon Energy also has a PE ratio of 113, which is comparable to its opponent and not as low or high. It’s also a positive sign that the PE ratio for its industry is fairly good.

The market capitalization is an additional indicator that separates Suzlon from its competitors, as the price of Suzlon is not as high as the market capitalization, suggesting that it will go up in the future.

Read More: TATA STEEL SHARE PRICE TARGET

Promotors Holdings

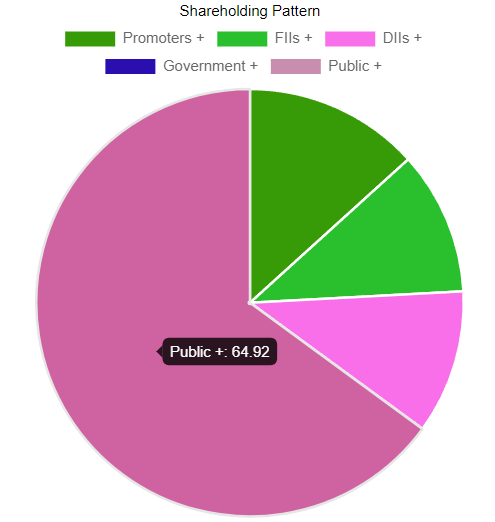

Promoters’ holdings are another indicator of how the company operates or its current state. As you can see from the pie graphic of different organizations’ capital, the public owns 64% of them.

This also indicates that there are fewer chances that the stock will collapse since if there are more promoter holdings, there is a chance that promoters will leave the firm and the company will fall severely. So it’s a good thing that the majority of the company is in public hands.

Read this too: स्टॉक मार्केट में निवेश करने से पहले किसी को क्या सावधानी रखनी चाहिए?

Technical Analysis of Suzlon Energy

Update: We confidently affirm that our prediction for Suzlon Energy shares, with a target of ₹34 in 2023, was made before it reached its current trading price of ₹37.60. Rest assured, our share price targets were well-researched and provided by the BazarProfit team.

As you can see, we are on the weekly timeframe of the Suzlon energy chart. Also, you can see that Suzlon Energy’s technicals on the chart are quite strong, which is a good indication that the stock will rise in the future.

As previously discussed, the fundamentals of Suzlon Energy are also quite solid, and now we have confirmation from Technical that it is a very good stock to buy.

As you can see, the 50-day moving average is additionally showing an uptrend, indicating that the stock is about to move. The trendline we created on the chart also displays the stock’s trending zone. It will shortly achieve the target of ₹34 in 2023.

The RSI relative strength index also indicates that the stock will rise and meet its targets in the future.

Read More: Evexia Lifecare Share Price Targets

Suzlon Share Price Target 2023-2050

Predicting the trajectory of a company’s stock price is a fascinating mystery in the investment world.

We aim to identify the strategic factors that could drive Suzlon Energy’s growth and determine its share price targets for the upcoming years.

By understanding the historical context behind these targets, investors can gain valuable insights into the potential factors that may accelerate the stock’s journey.

Read more: पेनी स्टॉक्स क्या है इन हिंदी और उन्हें कैसे ढूंढे ?

Suzlon Share Price Targets 2023-2080

Let’s delve into the anticipated share price targets for Suzlon Energy, featuring the projected minimum and maximum values for each year:

Suzlon Share Price Target 2023

The year 2023 could witness the following dynamics that might influence Suzlon Energy’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹18 |

| Maximum Target | ₹34 [Target Reached] |

Minimum Target (₹18): With a solid profit growth of 270%, Suzlon Energy’s performance highlights its capability to generate significant earnings. This growth could attract investors seeking stocks with upward potential, possibly bolstering its share price toward the minimum target.

Maximum Target (₹34): Despite facing a sales growth of -12.9%, the company’s impressive return over the past year (226%) reflects its potential for capital appreciation. Investors might view this as a sign of recovery, potentially contributing to a share price increase, although market volatility could play a role.

Suzlon Share Price Target 2024

As we look forward to 2024, several elements could impact Suzlon Energy’s share price movement:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹32 |

| Maximum Target | ₹67 |

Minimum Target (₹32): Suzlon’s resilience in overcoming challenges could position it as an attractive investment option. The company’s efforts to reduce debt and streamline operations might foster investor confidence, supporting its share price toward the lower target.

Maximum Target (₹67): Suzlon’s increased market cap and improved financials could attract a broader investor base, seeking stocks with promising growth prospects. The company’s ability to manage costs effectively and drive sales might contribute to achieving the higher share price target.

Suzlon Share Price Target 2025

The year 2025 holds potential for Suzlon Energy’s share price trajectory:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹50 |

| Maximum Target | ₹80 |

Minimum Target (₹50): The company’s renewed focus on sales growth could be a key driver. Suzlon’s expansion plans and ability to capitalize on its portfolio might lead to consistent revenue generation, potentially supporting its share price toward the lower target.

Maximum Target (₹80): Suzlon’s commitment to renewable energy solutions aligns with global sustainability trends. As governments and industries emphasize clean energy, the company’s wind energy solutions might garner increased attention, potentially contributing to achieving the higher share price target.

Suzlon Share Price Target 2026

In 2026, Suzlon Energy’s share price journey could be influenced by:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹72 |

| Maximum Target | ₹110 |

Minimum Target (₹72): The company’s focus on operational efficiency and innovation could enhance its competitive edge. Suzlon’s ability to maintain consistent profit growth and optimize costs might encourage investors, potentially propelling its share price toward the lower target.

Maximum Target (₹110): The renewable energy sector’s long-term growth potential could bode well for Suzlon Energy. As the world embraces sustainable solutions, the company’s role in providing clean energy might be viewed favorably by investors, potentially contributing to reaching the higher share price target.

Suzlon Share Price Target 2027

The year 2027 could witness the following dynamics that might influence Suzlon Energy’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹102 |

| Maximum Target | ₹148 |

Minimum Target (₹102): Suzlon’s strategic initiatives to diversify revenue streams could position it for steady growth. The company’s focus on innovation and exploring new markets might enhance investor confidence and potentially support its share price toward the lower target.

Maximum Target (₹148): As Suzlon Energy expands its footprint, particularly in emerging markets, it might attract investors seeking exposure to high-growth regions. The company’s ability to leverage its renewable energy expertise could contribute to achieving the higher share price target.

Suzlon Share Price Target 2030

The year 2030 could witness the following dynamics that might influence Suzlon Energy’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹178 |

| Maximum Target | ₹209 |

Minimum Target (₹178): Suzlon’s focus on innovation and technological advancements could lead to breakthroughs in wind energy solutions. As the company continues to enhance its product offerings, investor confidence might rise, potentially supporting the share price toward the lower target.

Maximum Target (₹209): Suzlon’s consistent profit growth and commitment to sustainable energy solutions align with global trends. As the world increasingly adopts renewable energy sources, the company’s expertise could position it for long-term growth, possibly contributing to achieving the higher share price target.

Suzlon Share Price Target 2035

The year 2035 could witness the following dynamics that might influence Suzlon Energy’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹300 |

| Maximum Target | ₹450 |

Minimum Target (₹300): Suzlon’s long-standing presence in the renewable energy sector could be a key factor. As the world transitions to cleaner energy sources, the company’s established reputation might attract investors seeking exposure to sustainable industries, potentially contributing to the share price toward the lower target.

Maximum Target (₹450): Suzlon’s role in addressing environmental challenges through renewable energy solutions could resonate with investors. As sustainability gains prominence, the company’s growth potential in the sector might drive investor interest, potentially supporting the share price toward the higher target.

Suzlon Share Price Target 2040

The year 2040 could witness the following dynamics that might influence Suzlon Energy’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹350 |

| Maximum Target | ₹500 |

Minimum Target (₹350): Suzlon’s continued focus on operational efficiency and cost management could yield positive outcomes. The company’s ability to optimize resources might resonate with investors seeking stable returns, potentially supporting the share price toward the lower target.

Maximum Target (₹500): Suzlon’s strategic expansion plans and global presence might attract investors seeking exposure to the growing renewable energy market. The company’s diverse portfolio and ability to capture market share could contribute to achieving the higher share price target.

Suzlon Share Price Target 2050

The year 2050 could witness the following dynamics that might influence Suzlon Energy’s share price:

| Target | Share Price (Rs) |

|---|---|

| Minimum Target | ₹600 |

| Maximum Target | ₹800 |

Minimum Target (₹600): Suzlon’s legacy in renewable energy could continue to resonate with investors over the long term. As the world moves toward a sustainable future, the company’s contributions to the clean energy sector might lead to increased investor confidence, supporting the share price toward the lower target.

Maximum Target (₹800): Suzlon’s ability to navigate industry trends and adapt to changing demands could position it as a leader in the renewable energy landscape. The company’s innovation and growth potential might attract investors seeking significant returns, potentially contributing to the share price achieving the higher target.

Suzlon Share Price Targets 2060-2070-2080

Suzlon’s shares are predicted to trade between ₹700 to ₹875 in 2060, suggesting the possibility for long-term growth and investor trust in the renewable energy sector.

By 2070, Suzlon’s share price targets broaden to ₹850 to ₹1050, reflecting the shifting industry landscape and Suzlon’s capacity to fulfill changing demands.

Finally, by 2080, the estimated Suzlon share price target ranges from ₹900 to ₹1200, demonstrating the company’s durability and capacity to play a big role in the future of the renewable energy sector.

Personal View on Suzlon Energy’s Future

According to me, the Suzlon energy share price will skyrocket till the end of 2023, making people extremely wealthy.

Over six months, the stock had already returned 192%. Also, because the government is investing in wind energy and turbines, the demand for this share will certainly increase in the future, causing the Suzlon share price to meet the targets set.

But yes, Again, this is not financial advice, please make sure to consult a financier advisor before making any investment decisions.

FAQ

What is the target price of Suzlon in 2030?

The target price for Suzlon in 2030 is estimated to be between ₹90 and ₹100.

What is the target price of Suzlon in 2023?

The target price for Suzlon in 2023 ranges from a minimum of ₹28 to a maximum of ₹34.

What will be the share price of Suzlon in 2024?

In 2024, the share price of Suzlon is expected to be within the range of ₹32 to ₹67.

What will be Suzlon’s share price in 2025?

Suzlon’s share price in 2025 is projected to range between ₹50 and ₹80.

Is Suzlon good for the long term?

Suzlon can be a good long-term buy and great for investment as Suzlon has many plans for the future and the company also planning on expanding the market. Recently Suzlon has secured an order for the development of a 100.8 MW wind power project for Everrenew Energy Pvt Ltd. For more info please read the detailed article.

Can Suzlon be a multibagger?

Suzlon is already a multi-bagger and is expected to provide more multi-bagger returns shortly, the stock has already given 192% returns over the six-month period of time.

What is Suzlon’s future plan?

Suzlon has secured an order for the development of a 100.8 MW wind power project for Everrenew Energy Pvt Ltd. The project is expected to be commissioned in March 2024 and involves the installation of 48 wind turbine generators.

Conclusion

Finally, Suzlon Energy Limited, a major leader in the renewable energy market, is positioned for a bright future. Suzlon’s share price is expected to rise in the next years as it focuses on extending its market presence and product line.

The efforts of the corporation to reduce debt, enhance financial performance, and align with the worldwide push for renewable energy position it well for long-term success.

According to financial calculations and estimates, Suzlon’s target share values from 2023 to 2080 show a favorable trend. However, keep in mind that investing decisions should only be taken after thorough analysis and consultation with financial advisors.

11 thoughts on “Suzlon Share Price Target 2023, 2024, 2025, 2026, 2030,2040-2050-2080”